accumulated earnings tax form

I elect not to have New Jersey income tax withheld. From Simple to Advanced Income Taxes.

Earnings And Profits Computation Case Study

Calculation of Accumulated Earnings.

. Ad IRS-Approved E-File Provider. The point of this tax is to encourage companies to issue dividends to their shareholders rather than sit on the earnings which ironically often leads to the shareholders paying taxes on the dividend. Ad accumulated earnings tax.

Metro Leasing and Development Corp. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to an accumulated earnings tax of 20. This tax is used to discourage companies from retaining profits but to pay dividends.

This is a federal tax charged to companies considered invalid and which have excess earnings that exceed the average rate. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b. Ad Find Deals on 2020 turbotax in Finance Software on Amazon.

Other non-bank financial intermediaries insurance companies taxable. The tax code imposes this penalty tax on C corporations with large accumulations of cash based upon the theory that companies holding what the government considers earnings in excess of the reasonable needs of the business likely do so as a means of evading or deferring shareholders income. The accumulated earnings tax is a penalty tax.

Recently the Tax Court had an opportunity to consider the computation of this penalty tax. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder - level tax seeSec.

Well Handle All Your Filing. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. When the amount of retained earnings in a company exceed a certain amount and is not distributed as dividends.

Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996. Your tax advisor knows your financial situation and can best assist you in choosing how to receive your benefit and minimize the tax you pay on this income. Quickly Prepare and File Your 2021 Tax Return.

Blank Forms PDF Forms Printable Forms Fillable Forms. An IRS review of a business can impose it. See If You Qualify.

If you are a New York State part-year resident you must file Form IT-203 Nonresident and Part-Year Resident Income Tax Return if you meet any of the following conditions. A Personal Services Company PSC can make profits of up to 150000 without having to pay these fees. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of.

Ad Build an Effective Tax and Finance Function with a Range of Transformative Services. Over 50 Milllion Tax Returns Filed. In periods where corporate tax rates were significantly lower than individual tax rates an obvious.

I elect to have New Jersey income tax withheld from the annuity payment. This tax evolved as shareholders began electing to have companies retain earnings rather than pay them out as dividends in an effort to avoid. Accumulated Earnings Tax Form will sometimes glitch and take you a long time to try different solutions.

To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. _____ FOR NEW JERSEY RESIDENTS ONLY. Keep in mind that this is not a self-imposed tax.

LoginAsk is here to help you access Accumulated Earnings Tax Form quickly and handle each specific case you encounter. It compensates for taxes which cannot be levied on dividends. Online Federal Tax Forms.

Every domestic corporation branch of a foreign corporation. See If Your Business Qualifies For the ERC Tax Credit. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary.

Easily Download Print Forms From. Request Your Free ERC Analysis. C corporations can earn up to 250000 without incurring accumulated earning tax.

Accumulated Earnings Tax. You are a part-year resident with any income during your resident period or you had New York source income during your nonresident period and your New York adjusted gross. Improperly Accumulated Earnings Tax IAET Return.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and. A fiscal tax year corporation must file Form 5452 with. Not included classified as closely-held corporation except banks and.

Demystifying Irc Section 965 Math The Cpa Journal

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

What Are Earnings After Tax Bdc Ca

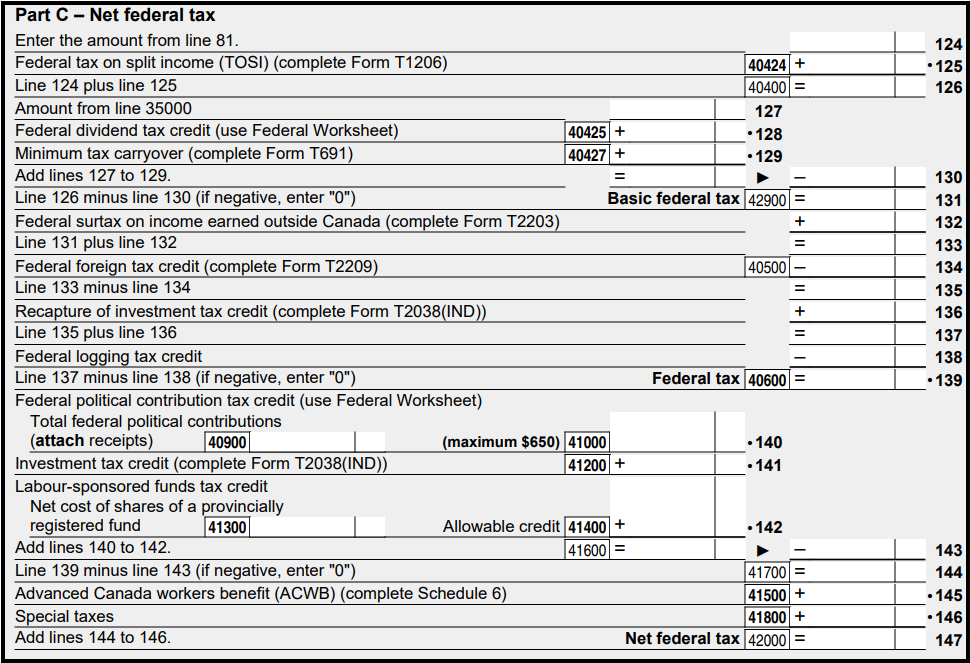

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

What Are Accumulated Earnings Profits Accounting Clarified

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Retained Earnings Formula And Calculator Excel Template

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

Demystifying Irc Section 965 Math The Cpa Journal

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study